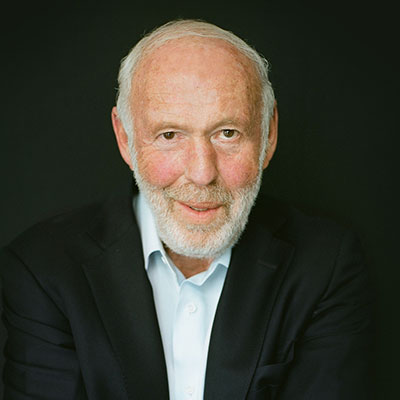

Warsaw, 11. May 2024 – It is with quite mixed feelings that I write this tribute tonight in memory of Jim Simons. In me, there is a profound sense of loss at the passing of Jim, a person whose influence in the financial world was profound. But there is also a kind of deep gratitude for the legacy he leaves behind and the inspiration he gave to me personally and to our team at Omphalos.

I first stumbled across the name ‘Jim Simons’ when I was trying to understand the nitty-gritty of quantitative finance. The Medallion Fund, this mysterious hedge fund he had invented, was like a mythical creature whispered about in the corridors of Wall Street. Its remarkable track record, shrouded in mystery, piqued my curiosity. When I delved deeper and discovered the astonishing average annual gross return of over 60 % over more than two decades, I was just fascinated.

It wasn’t only the hard figures that captivated me, but also the underlying philosophy. Simons dared to challenge the conventional wisdom of the financial world. He showed us that markets are not always efficient, and that mathematical rigor coupled with probabilistic thinking can lead to unprecedented success.

Reading ‘The Man Who Solved the Market’ by Gregory Zuckerman was finally the turning point for me: the book unraveled the mystery surrounding Simons, his fund and offered insights into his unorthodox investment approach. It made a deep impression on me because it confirmed the principles I had long believed in – trust in data, the principle of statistical analysis and the rejection of gut feelings in favor of hard facts.

Simons’ work, even if it has been kept somewhat shrouded in mystery, has left an everlasting impression on the investment world. At Omphalos, we have embraced his ethos. Our data-driven approach, based on probability theory and rigorous analysis, reflects the principles that have underpinned the success of the Medallion Fund.

Although we may never unlock all of Medallion’s secrets, we continue the spirit of innovation and commitment to pushing the boundaries of what is possible in finance. Our goal is bold: to achieve an annualized return of 66%, matching the heights achieved by Simons himself. This is a lofty goal, but we believe it is achievable with the right combination of vision, strategy, and determination.

I am convinced that if his methods had been made publicly available, Jim Simons would have made an enormous contribution to a better understanding of investing, like the Black-Scholes model. This ground-breaking model, discovered decades earlier by Edward von Thorp, revolutionized the investment industry only when it was rediscovered by Black, Merton and Scholes. It is a testament to the transformative power of innovative ideas – ideas that can reshape entire industries and pave the way for new opportunities.

We bid farewell to Jim Simons with a sense of gratitude for the inspiration he has given us and a determination to carry on his legacy. The financial world has lost a giant, but his spirit lives on in the work we do every day at Omphalos. May we honor his memory and continue to push the boundaries of what is possible in investment.

Warm regards,

Pawel Skrzypek