Revolutionizing Investments

with AI-Driven Strategies

The Fund

Discover the unique advantages that set Omphalos Fund apart in the world of investment management

5+ Years of Live Trading Expertise

A proven track record backed by real-world experience in delivering consistent performance

Artificial Intelligence & Machine Learning

Cutting-edge AI solutions that remove human emotion from decision-making processes

Multi-Strategy, Market-Neutral Approach

Diversified strategies across multiple asset classes to ensure balanced and resilient outcomes

Global Long/Short Trading

Seamless participation in opportunities across global markets

High-Water-Mark Assurance

A commitment to excellence, ensuring no fees are charged until new performance highs are reached

Compelling Sharpe Ratio with High Returns

Delivering optimized returns with a focus on low volatility

Resilience Across Market Conditions

Designed to perform positively, even in varying and unpredictable market environments

Pioneering the Future of Investment

Setting the benchmark for the next generation of systematic investment management and trading

Investment Objectives

Omphalos Fund is carefully designed to outperform traditional - active or passive - asset management strategies

Our main investment objectives

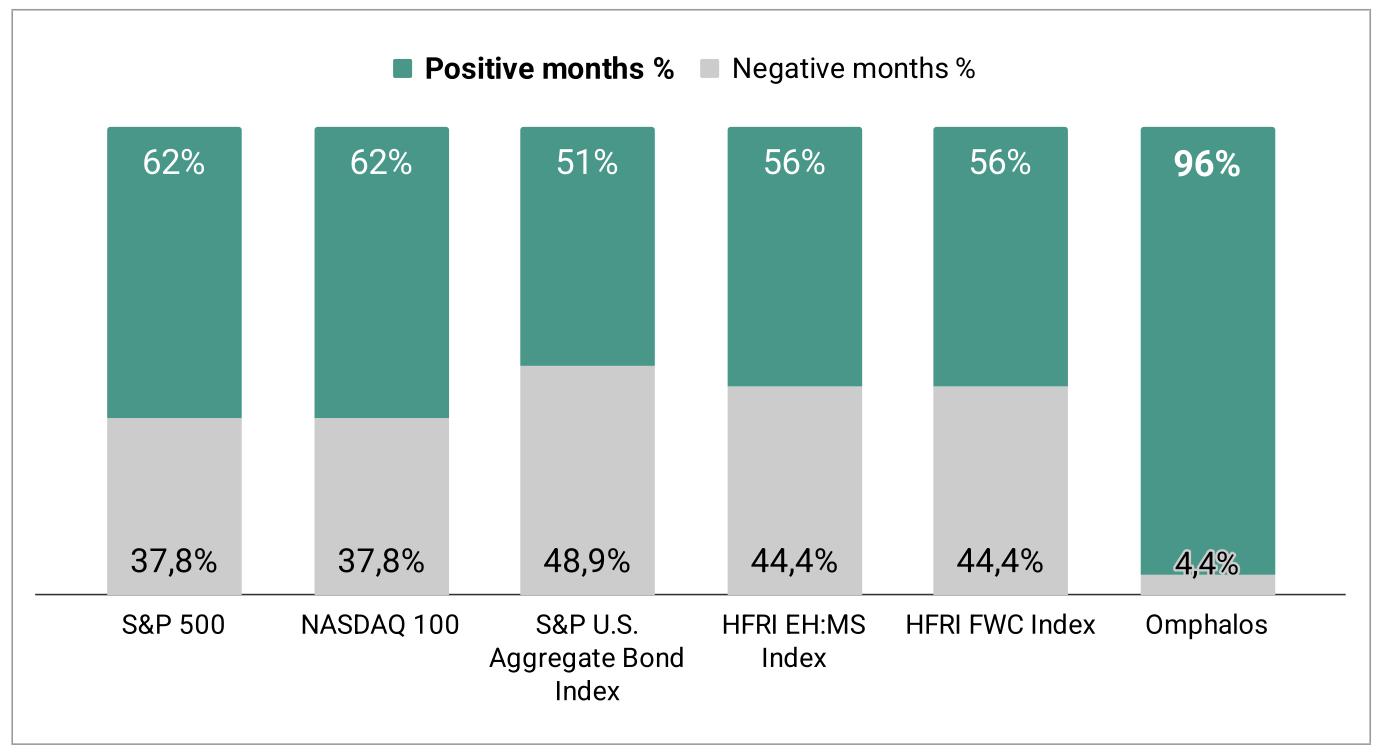

- To preserve capital in down markets with up markets participation.

- Targeting 90% plus monthly positive returns over a calendar year.

Monthly Win Rate: Omphalos vs Benchmarks

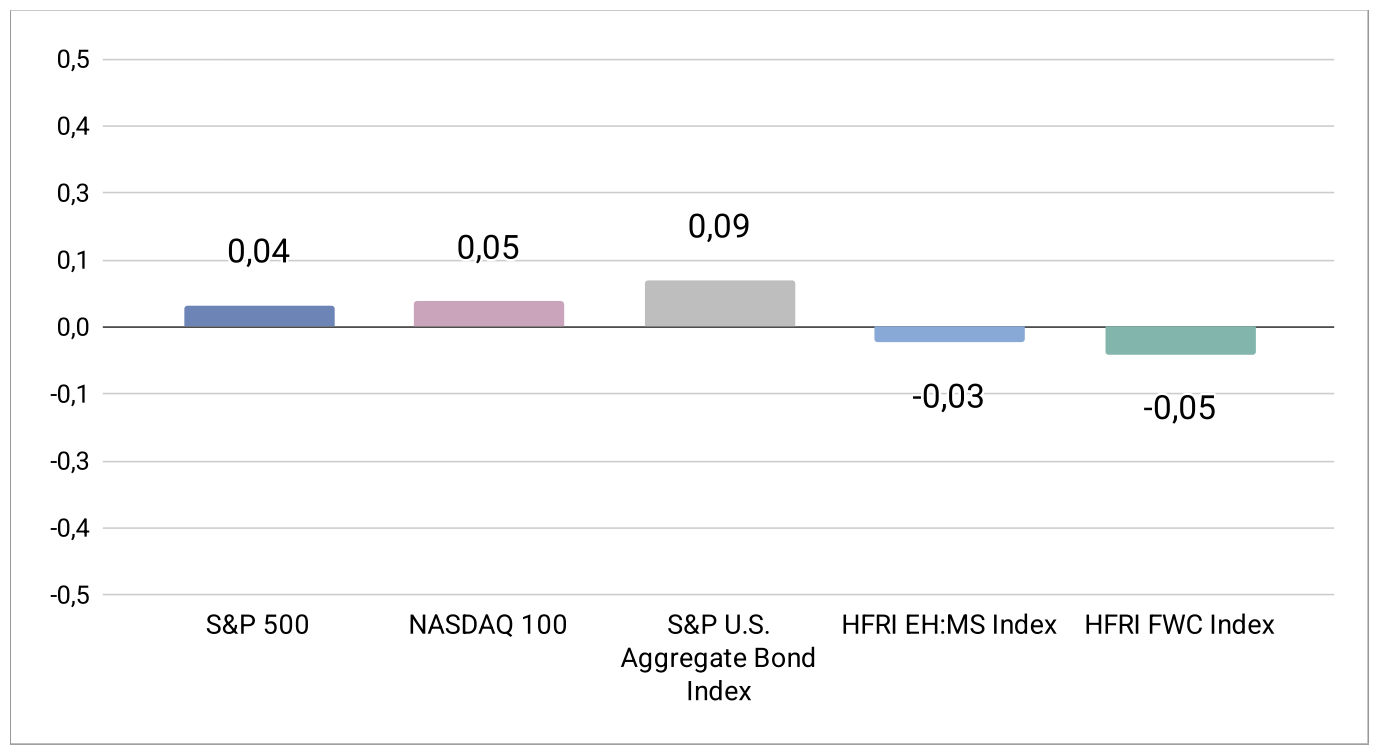

*Disclaimer: The Win Rate and Correlations charts reflect Omphalos Fund data from January 2022 through

September 30, 2025 (Q3). Figures may be preliminary and subject to revision; past performance is not

indicative of future results.

Omphalos Benchmark Correlations

Markets and Instruments

Where do we invest

The fund invests only in developed markets with highly liquid financial instruments.

We believe our diversity across instruments, strategies and time horizons contributes to a higher risk-adjusted return.

We believe our diversity across instruments, strategies and time horizons contributes to a higher risk-adjusted return.

List of markets & Instruments

- High liquidity stocks listed on: NYSE, NASDAQ, Börse Frankfurt, London Stock Exchange, Tokyo Stock Exchange and Euronext

- Stock indices: SP500, Dow Jones, Nasdaq100, DAX, FTSE, CAC40, Nikkei

- Developed markets government bonds

- Commodities: gold, silver, oil and other selected commodities

- Developed markets liquid currencies: USD, EUR, GBP, JPY, AUD, NZD, CHF

Our Edge

The most important advantages of our approach

Performance in Normal Market Conditions

Outstanding results during “normal” market periods.

Strict Risk and Exposure Management

Strict human control of risk and exposure.

Risk Control During High Volatility

Good results are supported by strict risk control during high-volatility periods.

Innovative Research Platform

Our research platform is designed to incorporate new forecasting methods and strategies continuously and

efficiently as they are discovered or become available.

Expert AI and Quantitative Research Team

Team of top-level data scientists and developers. Access to a large and sophisticated talent pool, as well

as to state-of-the-art cloud and multi-cloud optimized resources.

Long-Term Vision

Our long-term ambition is to follow Renaissance Technology, Volean and other quant funds by continuously

incorporating the most advanced AI technology and making the platform accessible to our investors.

AI Adaptability and Evolution

Our AI platform is continuously learning and evolving. It's designed to adapt to new data and market

conditions, allowing us to stay ahead in a rapidly changing investment landscape.

Commitment to Transparency

Transparency is key for trust. We have a clear overview, of what our AI platform is doing, at every moment.

We provide investors with regular insights into how our AI operates, the key performance data, and the risk

management protocols in place.

The Technology

The Future of Asset Management

Inspired by AlphaGO and the M4 competition the team behind the Omphalos Fund started developing the technology

in 2018 and launched the fund in January 2022.

AI is at the heart of our investment strategy - this is what the next generation of asset management is all about! It enables us to process vast amounts of data, identify patterns, and make predictive analyses that human managers or old-school IT platforms alone cannot. This leads to more informed and timely investment decisions.

AI is at the heart of our investment strategy - this is what the next generation of asset management is all about! It enables us to process vast amounts of data, identify patterns, and make predictive analyses that human managers or old-school IT platforms alone cannot. This leads to more informed and timely investment decisions.

How to Invest

Start your journey with Omphalos Fund